Shares Dip Despite Excitement Over Next-Gen Processor and Enterprise Software Launch

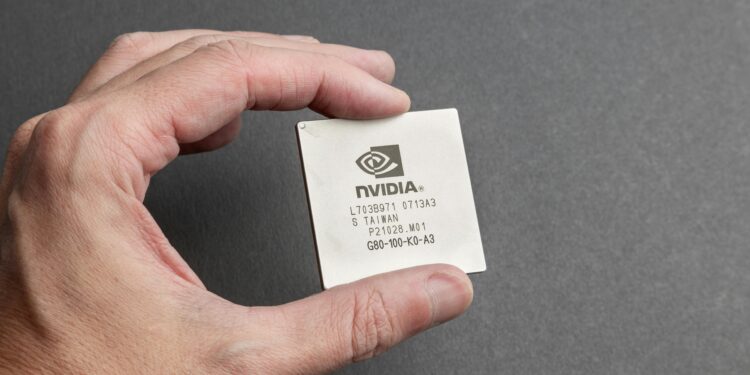

Nvidia’s (NVDA) shares experienced a slight dip of 3% on Tuesday morning following the announcement of its latest artificial intelligence chips, Blackwell, at the company’s developers conference in San Jose, California. CEO Jensen Huang introduced the new generation of chips, highlighting the GB200 as the first in the series, set to be shipped later this year. Despite the enthusiasm surrounding the launch, market response remained subdued.

In addition to the Blackwell chips, Nvidia also unveiled Nvidia Inference Microservice, a new enterprise software product aimed at simplifying the utilization of older generations of Nvidia GPUs.

Analysts offered mixed reactions to Nvidia’s announcements. Bernstein analysts maintained an outperform rating and a $1,000 price target on the stock, while Wells Fargo analysts reiterated their overweight rating, raising their price target to $970. However, some analysts expressed measured optimism, suggesting that the market may have anticipated more from the Blackwell B200 launch.

Despite the slight market downturn, analysts at Goldman Sachs maintained a buy rating on Nvidia stock, raising their price target to $1,000 and highlighting the company’s pivotal role in the AI space and its potential for widespread industry impact with the Blackwell chips.

You might like this:Charging Ahead: Shell’s Strategy for the Electric Future