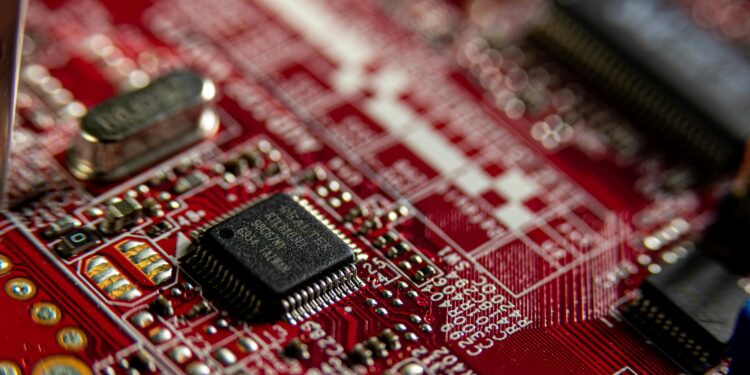

Chip Giant’s Struggles Highlight Challenges in Semiconductor Manufacturing

Intel (INTC), the renowned semiconductor company, revealed concerning figures regarding its foundry business in a recent filing with the U.S. Securities and Exchange Commission. According to the disclosure, Intel’s manufacturing unit faced a substantial increase in operating losses, totaling $7 billion for the year 2023, compared to $5.2 billion the previous year. Additionally, the unit’s revenue plummeted by 31% to $18.9 billion in 2023, down from $63.05 billion in the preceding year.

Following the filing, Intel’s shares experienced a 2% decline, reflecting investor apprehension regarding the company’s performance. Despite these challenges, Intel remains committed to its ambitious plans, earmarking $100 billion for the construction and expansion of chip factories across four U.S. states. The success of Intel’s turnaround strategy hinges on enticing external companies to utilize its manufacturing services, a pivotal step in reclaiming its competitive edge against primary rival Taiwan Semiconductor Manufacturing Co.

To enhance transparency and accountability, Intel intends to report the results of its manufacturing operations as a standalone unit, underscoring its dedication to revitalizing its position in the semiconductor market.

You might like this article:Bitcoin Slumps as Treasury Yields Rise and Dollar Strengthens