Expansion in Malaysia, New Collaborations, and Financial Performance Highlight the Quarter

Enovix Corporation (ENVX), a global leader in high-performance battery technology, has released its financial results for the second quarter of 2024. The report, delivered by President and CEO Dr. Raj Talluri, underscores a period of remarkable growth and strategic development for the company, marked by significant revenue increases, new collaborations, and the successful initiation of battery production in Malaysia.

Financial Highlights

Enovix reported a robust revenue growth of $3.8 million for Q2 2024, a substantial increase from the $42,000 reported in Q2 2023. This revenue exceeds the mid-point of the company’s forecasted range of $3.0 million to $4.0 million, signaling a positive trajectory for the rest of the year. Dr. Talluri anticipates significant revenue growth from the first to the second half of 2024, driven by the company’s expanding operations and strategic partnerships.

Strategic Partnerships and Commercial Progress

Enovix has made notable strides in commercializing its silicon battery technology. The company signed an agreement with a leading California-based technology firm to supply batteries for a mixed reality headset. Additionally, a collaboration with a Fortune 200 company will see Enovix’s batteries power a rapidly growing IoT product with a global user base.

The second quarter also saw Enovix secure a memorandum of understanding (MOU) with a high-performance global automotive OEM. This MOU, aimed at scaling the Enovix architecture for the automotive market, marks the company’s second agreement with a leading automotive OEM in 2024.

Expansion and Production in Malaysia

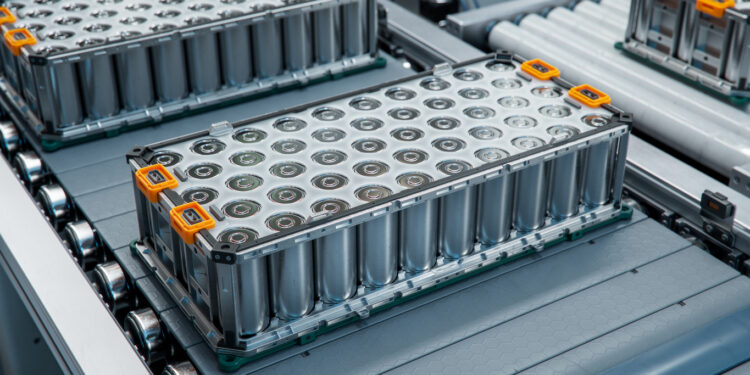

A major highlight of the quarter was the commencement of battery production at Enovix’s new facility in Malaysia. The company’s Agility Line completed site acceptance testing (SAT) and began producing EX-1M batteries. Furthermore, factory acceptance testing (FAT) for the high-volume Gen2 Autoline was successfully completed for all key modules, with full installation expected shortly.

The strategic move to Malaysia is part of Enovix’s broader plan to relocate high-cost manufacturing from California, targeting over $35 million in annualized savings. This transition is further bolstered by an at-the-market (ATM) offering completed in Q2, which has strengthened the company’s balance sheet and provided a solid financial runway.

Customer Engagement and Market Demand

Customer interest in Enovix’s silicon batteries remains high, particularly in devices with AI features that demand significant battery capacity. Dr. Talluri highlighted the increasing recognition among smartphone OEMs of the limited options available to deliver the necessary battery capacity in suitable form factors. This has driven strong engagement in this category and across various IoT markets where compact, energy-dense batteries are essential.

Enovix’s strategy focuses on high-value categories where improved battery performance can command premium pricing, supporting strong long-term margins. The company’s ongoing customer engagements validate this approach, demonstrating the substantial market potential for its innovative battery solutions.

Manufacturing and Commercialization Updates

In addition to starting production in Malaysia, Enovix’s operations team has been active in setting up a test and safety lab in Penang and relocating R&D pilot line equipment from Fremont to Penang. The safety lab is now operational, and the R&D pilot line is expected to be operational by the third quarter of 2024.

The company also shipped initial samples of the EX-1M battery from its Fremont facility for customer evaluation before transitioning production to Malaysia. Intensive testing protocols are being replicated to ensure quality and performance before shipping out samples from the new Fab2 facility.

Technological Advancements and R&D Expansion

Enovix continued to advance its EX-1M and EX-2M technology nodes, achieving targeted yield for large cells and validating high-energy density in prototype batteries using next-generation chemistries. The company has significantly expanded its R&D team, with core R&D headcount nearly doubling year-over-year, excluding the acquisition of Routejade. Including Routejade, the R&D headcount is up 167%.

The company’s lab in India is operational and evaluating next-generation battery materials, while a core R&D team in Malaysia is set to more than double by year-end.

Financial Performance and Outlook

In Q2 2024, Enovix reported a GAAP cost of revenue of $4.4 million, down from $7.1 million in Q1 2024, and a non-GAAP cost of revenue of $4.3 million, down from $5.2 million in Q1 2024. GAAP operating expenses rose to $88.1 million, primarily due to $38.1 million in restructuring expenses from shifting manufacturing operations to Malaysia.

The company’s GAAP net loss attributable to Enovix was $115.9 million, up from $46.4 million in Q1 2024, including significant non-cash charges related to restructuring and fair value adjustments of stock warrants. Adjusted EBITDA loss improved to $23.1 million from $26.3 million in the previous quarter.

For Q3 2024, Enovix forecasts revenue between $3.5 million and $4.5 million, a GAAP EPS loss of $0.30 to $0.36, an adjusted EBITDA loss of $23.0 million to $29.0 million, and a non-GAAP EPS loss of $0.17 to $0.23.

Enovix’s second quarter of 2024 marks a period of significant progress, with operational advancements in Malaysia, strategic partnerships, and robust financial performance. As the company continues to scale its manufacturing and expand its market presence, it remains well-positioned to capitalize on the growing demand for high-performance batteries across various industries.

Read original press release: here

You might like this article:Qualcomm Reports Strong Q3 Fiscal 2024 Results