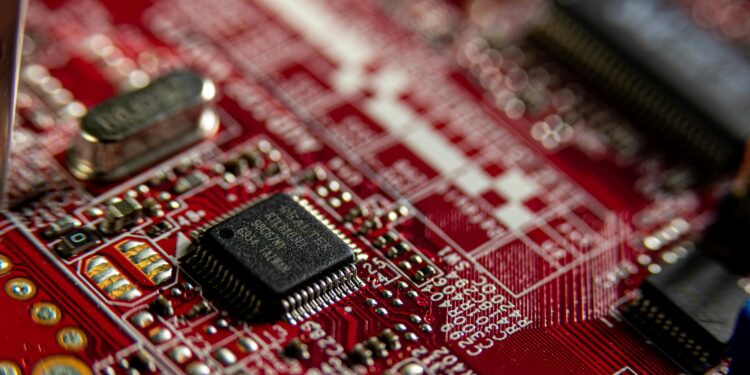

Analyst Upgrade Highlights Strong Growth Potential Amid AI and Semiconductor Trends

Advanced Micro Devices (AMD) could see its stock price surge by nearly 50% from current levels, according to a bullish outlook from Loop Capital. The firm recently reiterated its “Buy” rating on AMD, citing the company’s strong positioning in artificial intelligence (AI) and semiconductor markets as key drivers for future growth.

Loop Capital’s analysts emphasized that AMD’s recent innovations in AI-related chips, including its MI300 accelerators, position the company as a formidable competitor to NVIDIA in the burgeoning AI market. This comes at a time when demand for AI-powered solutions continues to expand across industries, ranging from data centers to autonomous vehicles.

“AMD’s roadmap is aligned with the most transformative tech trends,” Loop Capital noted. “With its strong execution and expanding partnerships, the company is poised to capture significant market share in the high-growth AI and semiconductor segments.”

The firm also highlighted AMD’s resilient financial performance despite broader macroeconomic headwinds. In its most recent earnings report, AMD reported robust revenue growth, driven primarily by its data center and embedded segments. While consumer PC sales have faced challenges, the ongoing recovery in this segment could provide an additional boost to AMD’s overall performance.

Currently trading at approximately $100 per share, AMD’s valuation remains attractive, according to Loop Capital. The firm set a price target of $150, indicating a potential upside of 50%. This bullish target reflects the expectation of accelerating demand for AMD’s next-generation products and its ability to expand margins as it scales operations.

Investors have been keeping a close eye on AMD as it competes with both NVIDIA and Intel in a highly competitive market. The company’s ability to balance innovation with strategic partnerships and maintain steady growth could make it a top pick for investors seeking exposure to AI and semiconductors.

As AMD continues to leverage its technological edge and strategic vision, analysts suggest the stock is well-positioned to deliver substantial returns for investors.

You might like this article:Inspira Technologies Unveils Modular VORTX Blood Oxygenation System