AI-driven rally sends chipmaker past tech giants as it cements status as Wall Street’s most valuable company

Nvidia (NVDA) made history on Wednesday, becoming the first publicly traded company to surpass a $4 trillion market valuation, capping off a remarkable two-year rally fueled by surging demand for artificial intelligence.

Shares of the semiconductor giant rose 2.5% in early trading, gaining $3.97 to trade above $164 per share. Just 18 months ago, Nvidia shares were trading around $14, making its meteoric rise one of the most dramatic in modern stock market history.

Widely viewed as the face of the AI revolution, Nvidia has surpassed tech titans like Microsoft, Apple, Amazon, and Google to become the most valuable company on Wall Street. At over $4 trillion, it now ranks alongside Apple in its influence on the S&P 500 and other major indexes.

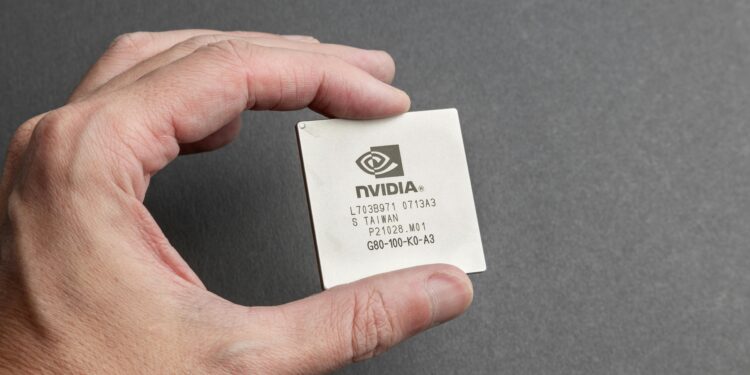

Nvidia’s climb has been central to the broader stock market rally, which has repeatedly hit record highs in recent months. The company’s booming profits—driven by its dominance in AI chips and infrastructure—have helped offset macroeconomic concerns ranging from inflation to geopolitical tensions and evolving U.S. trade policy.

Two years ago, Nvidia’s market cap was under $600 billion. Today, it’s at the forefront of the AI gold rush, supplying the high-performance chips that power everything from data centers to AI model training across industries.

While some analysts caution that market enthusiasm may be outpacing fundamentals, Nvidia’s continued growth has firmly cemented its position as a critical enabler of the global AI transformation—one that investors believe is still in its early stages.

You might like this article:Trump Executive Order Deals Blow to U.S. Solar Sector