The big picture

Over the past year, KULR’s stock has behaved more like a Bitcoin proxy than a niche industrial battery name. Crypto rallies lift the shares, while Bitcoin pullbacks usually drag them down.

At current prices, investors still give little credit to the battery business, even though that segment is moving from pilot programs toward early commercial shipments.

I do not expect valuation to change meaningfully until battery revenue becomes visible and recurring. Until then, crypto headlines are likely to dominate trading.

Why I’m watching KULR

What stood out was how tightly KULR’s share price tracked Bitcoin despite management’s focus on building a battery platform.

Regulatory filings reinforce that view. Crypto exposure dominates discussion, while factory output, customer qualification, and contract wins get far less attention.

Over time, I believe execution in batteries — not Bitcoin — will decide where the shares trade.

How I see the setup

I view KULR as an early-stage battery manufacturer that happens to hold Bitcoin and operate limited mining capacity on the side.

At today’s valuation, most of the stock price appears tied to crypto assets rather than the operating business underneath.

The balance sheet provides some downside protection, but meaningful upside requires steady battery shipments instead of isolated pilot projects.

This remains a high-risk investment. Battery execution will determine whether the stock rerates.

What the company does

KULR designs lithium-ion battery packs and thermal-management systems for safety-critical uses.

The company avoids consumer electronics and instead targets defense programs, telecom infrastructure, data centers, and industrial customers.

Management positions the KULR ONE battery pack as the core growth product. These markets take time to qualify into, but once approved, contracts can last for years.

Why the Caban deal matters

The five-year preferred supply agreement with Caban Energy expanded KULR’s U.S. manufacturing footprint in Plano, Texas, and strengthened its position in telecom and data-center energy storage.

Source: KULR Technology Group press release, “5-Year Preferred Battery Supply Agreement with Caban Energy.”

The deal does not make KULR a scaled producer overnight, but it signals that customers are moving beyond pilot programs.

Bitcoin on the balance sheet

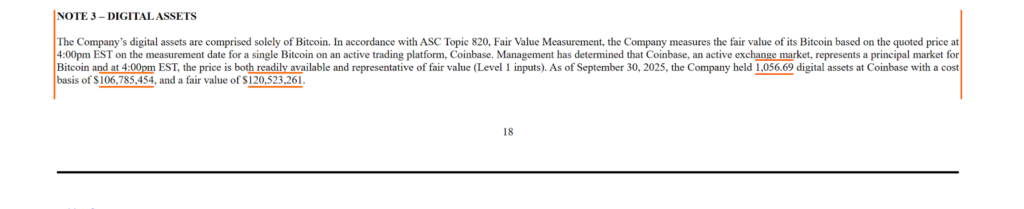

As of September 30, 2025, KULR reported holding 1,056.69 Bitcoin at fair value.

Source: KULR Technology Group, Form 10-Q (Q3 2025).

Those holdings have become a visible part of the company’s financial profile and a major factor in daily trading.

How Bitcoin fits into the strategy

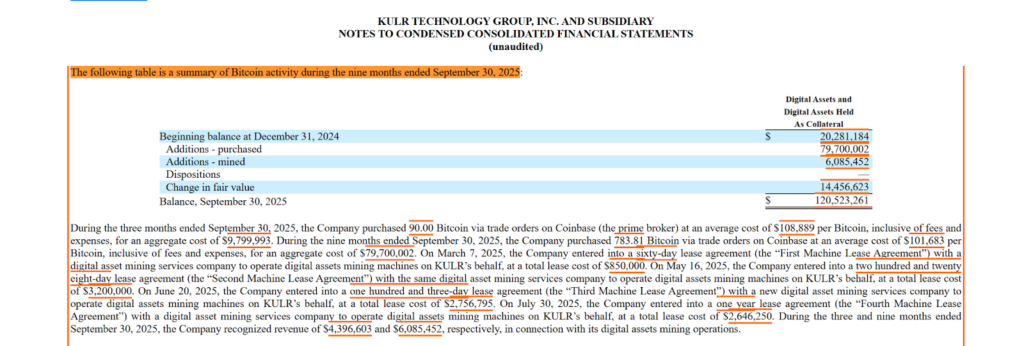

KULR is not trying to become a Bitcoin miner. Management frames mining and crypto holdings as part of a treasury strategy, not the operating engine.

The company combines open-market purchases with limited mining when economics make sense.

A hosting agreement with Soluna Holdings supports roughly 3.3 MW of mining capacity without owning equipment.

Source: KULR Technology Group, Form 10-Q (Q3 2025).

Filings show modest mining revenue, reinforcing that crypto activity remains secondary to the battery business.

Financial position and dilution

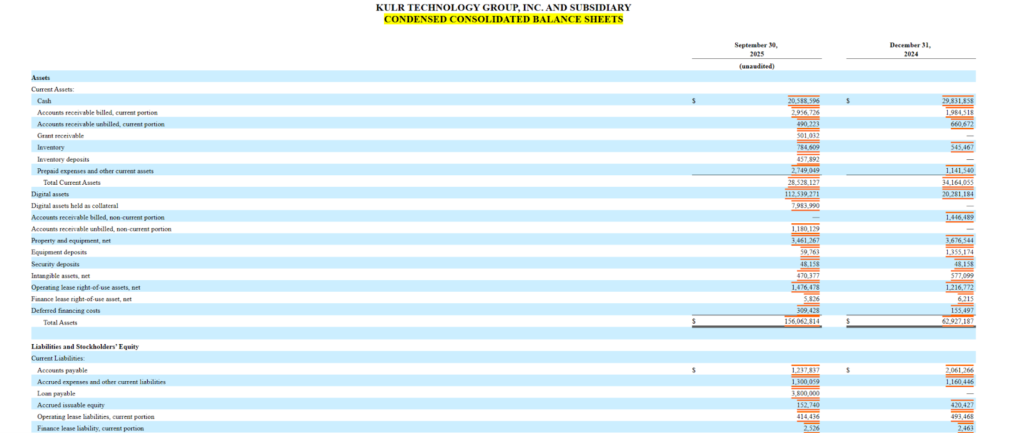

KULR reported no long-term debt as of September 30, 2025, and repaid its Bitcoin-backed facility in October.

Source: KULR Technology Group, Form 10-Q (Q3 2025).

On December 22nd, KULR’s management announced they paused their at-the-market financing with Cantor-Fitzgerald and Craig-Hallum through June 30, 2026. This is welcome news to shareholders as it (1) removes any near-term dilution pressure (2) signals financial confidence and (3) enables the company to focus on operational execution over financing distractions.

Valuation snapshot

At today’s market capitalization of roughly $162 million, KULR trades at about 10× trailing sales.

That multiple reflects investor caution around scaling production and the stock’s volatility tied to Bitcoin sentiment.

If the battery segment can grow revenue meaningfully over the next two years while improving margins and factory utilization, the shares would begin to screen cheaper on a forward basis — even if market capitalization stays flat.

On a trailing twelve-month (TTM) price-to-sales basis, KULR trades at a significant discount to its battery and energy-storage peers. At roughly 11x TTM P/S, KULR is valued at about one-quarter of SES AI and Enovix, both of which trade in the mid-40s P/S range. Amprius also commands a meaningfully higher valuation, trading in the mid-20s to low-30s P/S on a TTM basis. QuantumScape, despite a market capitalization exceeding $5 billion, effectively has no meaningful TTM P/S multiple due to negligible trailing revenue. These valuation disparities persist across other metrics as well, including enterprise value-to-sales and price-to-book, underscoring KULR’s relative undervaluation.

Bottom line

KULR still trades on crypto headlines. That creates volatility — and potential opportunity.

If management converts pilot projects into steady battery revenue, the stock should begin trading on industrial fundamentals rather than Bitcoin sentiment.