Record-Breaking Demand for AI Chips Drives Nvidia to New Heights

Nvidia (NVDA) insiders have sold shares worth more than $700 million this year, capitalizing on the company’s record-breaking stock surge fueled by unprecedented demand for its high-performance chips. This wave of insider sales has involved about 770,000 Nvidia shares, marking the highest volume since the first half of 2023, when approximately 848,000 shares were sold, according to data compiled by the Washington Service.

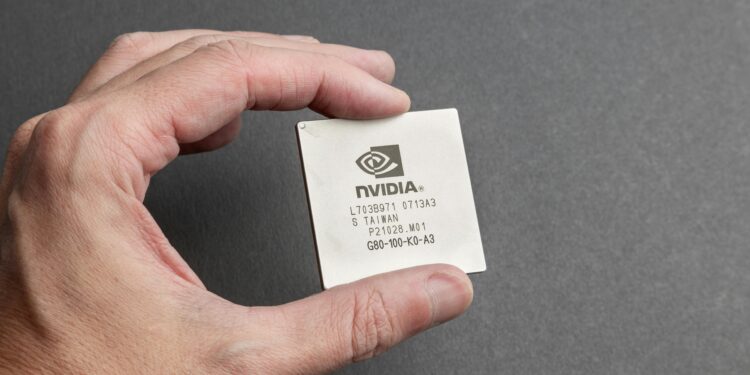

The financial magnitude of this year’s share sales far surpasses previous periods due to Nvidia’s stock appreciating by 164% in 2024. This growth has been driven by an arms race among companies to enhance computing power, boosting the demand for AI accelerator chips—a market where Nvidia holds a dominant position.

Mark Lehmann, CEO of Citizens JMP Securities, suggests that while the insider selling is notable, it should not be cause for alarm. He points out that compensation in stock is common and that there is no indication of diminishing demand for Nvidia’s products. “Anytime you see this kind of wealth being created and the type of market cap being created, I always look for who is coming and going, and I have not seen an exodus of the people that got us to this market cap,” Lehmann stated in an interview. “That would be more concerning.”

Nvidia, now the third most valuable company globally with a market capitalization of about $3.22 trillion, trails only Microsoft Corp. and Apple Inc. in market value. Notably, more than a third of the insider sales occurred after Nvidia’s fiscal first-quarter earnings report on May 22. This report included a revenue forecast that exceeded expectations and announced a stock split, causing the shares to soar. Significant sellers include directors Mark Stevens and Tench Coxe, with CEO Jensen Huang also reporting the sale of about $31 million in shares under a pre-arranged trading plan.

Despite the significant insider sales, there has been a noticeable lack of insider purchases. Since December 2020, there have been no insider stock purchases at Nvidia, apart from the exercising of options. This last purchase was made by CFO Colette Kress, who bought $107,390 in shares.

Nvidia’s soaring stock has contributed to a rally in megacap stocks, pushing the Nasdaq 100 index to a new record high. However, the artificial intelligence rally shows signs of overheating, with the index’s 14-day relative strength index—an indicator of price momentum—at its most overbought level since 2018, suggesting a potential pullback.

In other tech news, Apple Inc. is shutting down its Pay Later program, the US Federal Trade Commission has sued Adobe Inc., and Huawei Technologies Co. is considering taking a cut of in-app purchases on its Harmony mobile operating system. Meanwhile, UK startup CuspAI has raised $30 million in its initial funding round, with AI pioneer Geoffrey Hinton joining its advisory board.

You might like this article:CleanSpark Acquires Five New Bitcoin Mining Facilities in Georgia, Expanding Infrastructure by 60 MW