Revised Estimates, Updated Sales Outlooks, and Strategic Insights

The automotive industry is in a constant state of flux, with changing dynamics in sales forecasts, supply chains, valuations, and policy implications. Our latest report provides a comprehensive update on these key areas, alongside revised estimates for companies such as Aptiv (APTV), Tesla (TSLA), Wolfspeed (WOLF), and Albemarle (ALB). We also delve into the performance and strategic direction of ChargePoint (CHPT).

Albemarle (ALB)

Outperform, $178 PT

Albemarle, the largest global lithium provider, faces challenges as lithium prices decline. With June spot prices dropping by over 10%, we anticipate a potential guidance cut. While bilateral auction activity may offset some pricing softness, index contracts are likely to weigh on overall pricing. Despite these challenges, Albemarle’s chemical processing expertise continues to enhance its market position, especially as lithium demand is expected to outpace supply in the long term. Consequently, we have lowered our revenue, adjusted EBITDA, and adjusted EPS estimates for FY24 to $5.52B/$1.65/$952M (from $5.80B/$2.40/$1,075M). Similar adjustments have been made for FY25 and FY26, with a new price target of $178.

Updating Light Duty Vehicle (LDV) Sales Outlook

We have raised our FY24-26 LDV sales forecast, now estimating 2024 LV sales at 92.4M units, a 2.8% year-over-year increase (from 91.9M/2.3%). This adjustment is driven by stronger demand in China, Latin America, and Eastern Europe, which is expected to offset weaker demand in North America and Western Europe. However, our estimate for EV penetration rate has slightly eased to 24.1% from 24.3% through FY26.

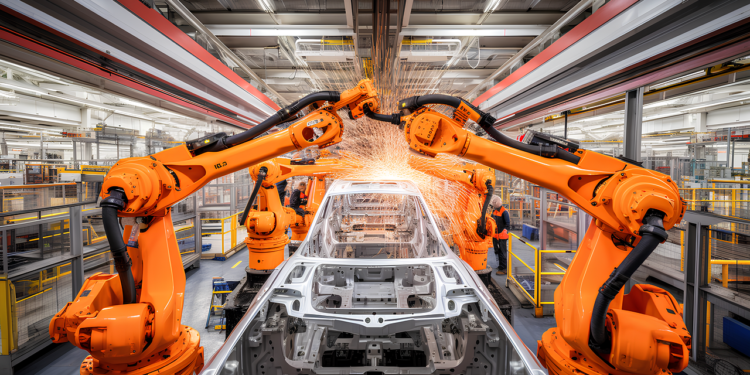

Supply Chain Dynamics

Supply chains have shown incremental improvement in the second quarter, supported by moderating inflation and stable to declining fuel and energy prices. Despite this positive trend, the operating environment remains vulnerable to disruptions, such as those in the Red Sea due to Houthi rebel attacks, the Key Bridge collapse in Baltimore, and the severe drought affecting the Panama Canal. These disruptions pose risks to the normalization of supply chains through the remainder of 2024.

Valuations

Tier 1 auto supplier valuations fell further during the second quarter of 2024, ending the period half a standard deviation below three-year averages. The valuation trends among individual stocks have converged, with all Tier 1 auto supplier valuations remaining below long-term averages. Growth-oriented companies continue to face a challenging environment due to a higher cost of capital and lower customer risk tolerance.

Policy Implications

The Biden administration has announced a significant increase in tariffs on electric vehicles (EVs) from China, rising from 25% to 100% in 2024. Although there are currently very few Chinese-made EVs in the US market, these tariffs are intended to protect American manufacturers. Similarly, the European Union has introduced tariffs of up to 38.1% on Chinese EVs, effective from July, following an anti-subsidy investigation.

Company-Specific Updates

ChargePoint (CHPT)

ChargePoint has experienced a decline in its share of new public charging stations and ports in the US, representing 55% of stations brought online in 2Q, down 11 points quarter-over-quarter and 8 points year-over-year. Despite this, the company remains above its two-year average share for DC fast charging (DCFC) ports. Improved hardware sales are expected to support margin expansion, even in a challenging macro environment. With $7.5B in federal funding for EV charging infrastructure under the Infrastructure Investment and Jobs Act (IIJA) and increased EV credits in the Inflation Reduction Act (IRA), ChargePoint is well-positioned to benefit from these programs. The company continues to work towards positive EBITDA in FY25, emphasizing cost management and operational efficiency.

Tesla (TSLA)

Tesla’s vehicle sales have shown quarter-over-quarter recovery, with a reduction in inventory. Key areas of focus include the strength of energy storage sales, the anticipated impact of the Model 3 refresh and Model 2, and the monetization potential of Full Self-Driving (FSD) technology. While bulls highlight Tesla’s technological leadership in FSD and AI, bears remain skeptical about margins and valuation. We anticipate further details on Tesla’s monetization strategy during the 2Q24 call. Our revised estimates for FY24 are $100.4B in revenue and $2.36 in adjusted EPS (down from $102.8B/$2.48), with adjustments for FY25 and FY26 as well.

You might like this article:NVIDIA Corp: Raising Price Target to $150 Amid Strong Demand for Blackwell Systems