Stocks Near Record Highs Amid Anticipation of AI Leader Nvidia’s Earnings and Key Economic Data

Federal Reserve Chair Jerome Powell’s recent comments have set the financial world abuzz, leading to a significant rally in U.S. stocks. On Friday, Powell signaled that the central bank might be ready to shift gears, stating, “time has come for policy to adjust.” The market, eager for signs of a more dovish stance from the Fed, responded by pushing major indices to near-record levels.

The S&P 500, Nasdaq Composite, and Dow Jones Industrial Average all closed the week with gains exceeding 1%. The S&P 500 is now within a mere 1% of reaching an all-time high, reflecting investor optimism. However, this bullish sentiment faces a critical test in the coming days, with high-profile earnings reports and a key inflation reading on the horizon.

Powell’s Signal and Market Response

Powell’s remarks on Friday clarified that the Fed is likely to begin cutting interest rates in September, a move that investors have been anticipating. However, he stopped short of specifying the magnitude of the rate cuts, stating that the pace and timing would depend on incoming economic data. This ambiguity left markets speculating about the possibility of a more aggressive easing cycle.

The Fed chair emphasized that the central bank has “ample room” to maneuver as it enters this new phase of policy. This flexibility has led to market speculation that the Fed could implement four rate cuts of 0.25% each by the end of 2024. The question now is whether the Fed might opt for a more significant 0.50% cut in one of its remaining meetings this year.

Goldman Sachs economists, led by Jan Hatzius, suggested that a weaker-than-expected August jobs report could prompt the Fed to deliver a 50 basis point (bp) cut at its September meeting. As of Friday afternoon, markets were pricing in a 38.5% chance of a 50 bp cut by the end of September, a notable increase from the previous day’s 24% probability, according to the CME’s FedWatch Tool.

However, some analysts, like Jonas Goltermann from Capital Economics, cautioned that a more substantial rate cut could signal underlying economic weakness, potentially unsettling investors. “Investors may reasonably worry that if the FOMC feels the need to front-load policy easing, it may be because the economy is slowing by more than the still very rosy outlook discounted in equity and credit markets implies,” Goltermann wrote in a note to clients.

Despite the focus on interest rates, Powell also highlighted the ongoing risks to the labor market, with the Fed’s eyes set on a crucial inflation report due this Friday. Economists are expecting the core Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, to show an annual increase of 2.7% for July, slightly up from June’s 2.6%. This data will be closely watched as it could influence the Fed’s policy decisions in the coming months.

Nvidia Earnings: The Market’s Next Big Test

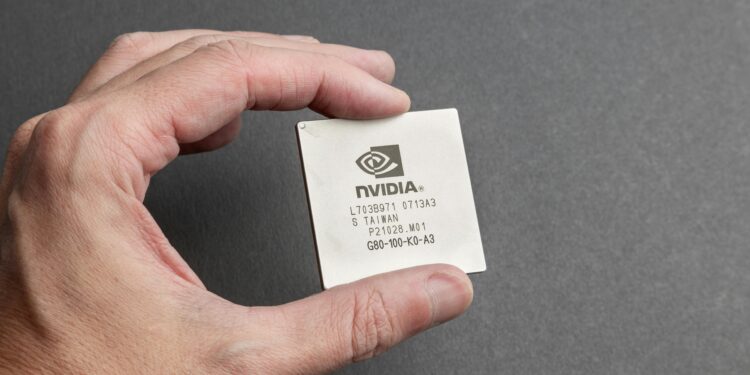

As the week unfolds, all eyes will turn to Nvidia, the semiconductor giant that has been at the forefront of the AI-driven stock market rally. Nvidia’s earnings report, scheduled for release after the bell on Wednesday, is highly anticipated by investors and analysts alike. The company is expected to report a staggering 109% year-over-year increase in earnings, with revenue likely up 99% from the same quarter last year.

Nvidia’s dominance in the AI sector has propelled its stock price to new heights, with shares up approximately 160% year to date. Any updates on potential delays for its upcoming Blackwell chip will be particularly scrutinized by the market. KeyBanc analyst John Vinh recently expressed confidence in Nvidia’s prospects, predicting that the company will beat earnings expectations and raise its guidance. “We expect NVDA to report beat/raise results, in which upside will be driven by strong demand for Hopper GPUs,” Vinh noted.

Vinh also suggested that despite the stock’s recent 30% rally, Nvidia remains attractively valued. “Being one of the best-positioned semiconductor companies, obviously levered to one of the strongest product cycles in AI right now, we think it’s still attractively valued at these levels,” he said.

Charles Schwab Asset Management’s CEO, Omar Aguilar, echoed this sentiment, emphasizing that Nvidia’s outlook on AI demand and future chip sales will be critical not just for the company but for the broader market. “What I think is going to be expected by the market is to hear what is the outlook for AI and what is the demand for chips going forward as people continue to spend money in AI technologies,” Aguilar told Yahoo Finance.

Tech Volatility: A Thing of the Past?

The volatility that has characterized tech stocks, particularly the “Magnificent Seven” (Apple, Alphabet, Microsoft, Amazon, Meta, Tesla, and Nvidia), might be nearing an end, according to some market analysts. Goldman Sachs equity strategist Ben Snider believes that the wild swings seen in these stocks could be behind us, at least for the near term. “I think most of the short-term volatility in [the Magnificent Seven] stocks is behind us,” Snider told Yahoo Finance.

The recent rally in these tech giants added more than $1.4 trillion to their collective market cap between August 5 and August 19. Despite concerns earlier in the year that the AI investment boom might be tapering off, the resilience in sales and earnings growth has reassured investors.

Interestingly, for the first time since early 2022, hedge funds have reduced their exposure to most of these tech stocks, with Amazon and Apple being the exceptions. This shift, Snider suggests, reflects investor anxiety ahead of the second-quarter earnings season, though the subsequent market rebound has tempered these concerns somewhat. “I would call sentiment [around megacap tech] cautiously optimistic,” Snider said.

As the market enters this crucial week, the combination of Nvidia’s earnings report and the upcoming inflation data could set the tone for the remainder of 2024. Investors will be watching closely to see whether the market can maintain its upward momentum or if the looming challenges will cause it to stumble.

You might like this article: Small Caps Continue to Shine Amid Market Dynamics, Says Carson Group’s Strategist