AI Server Maker Super Micro Gains 14% Amid Growing Demand for AI Hardware and Rising Short-Seller Pressure

Super Micro Computer (SMCI), a leading player in AI server technology, saw its shares jump by 14% on Monday following a pivotal announcement that included impressive shipment figures and the launch of new liquid cooling products. The company revealed that it is now shipping over 100,000 graphics processing units (GPUs) per quarter and introduced a new range of direct liquid cooling (DLC) solutions designed to handle the increasing demands of artificial intelligence (AI) workloads. This news comes as a welcome reprieve for the AI server maker’s investors, who have seen the stock in a prolonged slump in recent weeks.

AI Demand Boosts Super Micro’s Growth

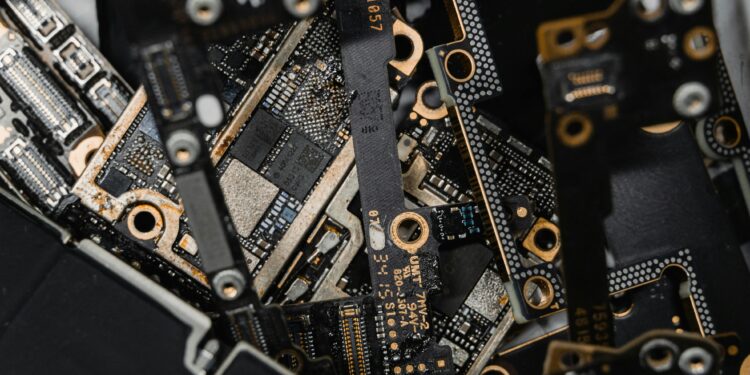

The recent surge in demand for generative AI technology, which requires significant computing power to process vast datasets, has been a key driver for Super Micro’s business. The company is known for producing high-performance servers that incorporate cutting-edge AI chips, such as those made by Nvidia, to meet the growing needs of AI applications.

In a statement, Super Micro highlighted its role in deploying more than 100,000 GPUs with its DLC technology for “some of the largest AI factories ever built.” The company’s DLC products are specifically designed to optimize power efficiency and performance, as they provide better cooling solutions than traditional air cooling systems used in many data centers.

Liquid cooling technology is becoming increasingly essential as AI models grow more complex and resource-intensive, leading to higher power consumption and heat generation. Super Micro’s innovation in this area positions it to capitalize on the booming AI market by offering a more energy-efficient alternative to air cooling. This capability, coupled with its early access to Nvidia’s sought-after AI chips, gives the company a significant edge in the highly competitive AI server space.

Nvidia Partnership Strengthens Super Micro’s Position

Super Micro’s close partnership with Nvidia, one of the most dominant players in the AI hardware market, has played a crucial role in its ability to deliver top-tier products. Nvidia’s shares also saw a 3% increase on Monday, highlighting the broader market’s recognition of the symbiotic relationship between the two companies. Nvidia’s GPUs are essential components for AI training and inference tasks, making them critical to the functionality of Super Micro’s servers.

The new line of DLC products announced by Super Micro will allow data centers to maximize GPU density, with the ability to support up to 96 Nvidia Blackwell B200 chips per server rack. This capability is expected to help the company further expand its market share, particularly as the latest Nvidia GPUs become available later this year.

“Providing demonstrable solutions will help the company gain market share, especially once the newer Nvidia Blackwell GPUs come to market later this year,” said Gadjo Sevilla, senior AI and tech analyst for eMarketer. Sevilla’s comments underscore the importance of Super Micro’s continued innovation in staying ahead in the fast-evolving AI hardware landscape.

Short Seller Pressure and Stock Recovery

Super Micro’s stock rally on Monday marks a significant recovery after weeks of decline. The stock had been under pressure since Hindenburg Research, a prominent short-selling firm, disclosed a short position in the company in August. In the two weeks leading up to Monday’s announcement, Super Micro’s shares had dropped more than 9%, though the stock remains up over 66% for the year, largely thanks to the ongoing rally in AI-linked stocks.

Market research firm Ortex estimates that short interest in Super Micro stands at over 20% of its free float, valued at around $3.59 billion. This heavy short interest could have been a contributing factor to Monday’s sharp rise, as short sellers may have been forced to buy back shares to cover their positions.

“If this is related to short sellers trying to buy back shares or not is too early to tell at this point, but at the current price, short sellers are making short-term losses and may choose to close their positions,” Ortex noted, suggesting that short covering may have added momentum to the stock’s gains.

A Promising Future for AI Hardware Makers

Super Micro’s impressive quarterly GPU shipments and its pioneering liquid cooling technology reflect the broader trends in the AI hardware market, where demand for high-performance computing infrastructure continues to grow. The company’s strong partnership with Nvidia, coupled with its ability to innovate in areas like energy-efficient cooling, positions it well to capitalize on the ongoing AI boom.

As AI applications become more integrated into various industries, the need for robust server solutions will only increase, providing Super Micro with multiple growth opportunities in the coming years. The recent stock surge indicates investor confidence in the company’s ability to navigate both technological advancements and market pressures.

You might like this article:Emerging Therapeutic Developments: TYRA, RVMD, IDYA, and More Poised for Key Data Releases