Chinese Demand Declines as Semiconductor Equipment Giant Faces Market Uncertainty

ASML (ASML), the Dutch semiconductor equipment manufacturer, has issued a revised forecast for its 2025 net sales, indicating potential revenue between 30 billion euros ($32.72 billion) and 35 billion euros. This range reflects the lower half of the company’s earlier guidance, surprising both analysts and investors. The announcement, which was unexpectedly released a day early, sent shockwaves through the semiconductor market, causing ASML’s stock to plunge by 15.6% on Tuesday. Major semiconductor firms, including Nvidia, Advanced Micro Devices (AMD), and Broadcom, also saw their shares drop by at least 4% following the news.

ASML’s updated financial outlook suggests slower-than-expected recovery in key market segments. CEO Christophe Fouquet acknowledged in the earnings release that, while there is continued growth in the AI sector, other areas are facing more significant challenges. “It now appears the recovery is more gradual than previously expected,” Fouquet stated, signaling that the broader chip industry is still grappling with demand fluctuations after the boom driven by pandemic-era digitalization.

Weak Net Bookings Raise Concerns

One of the most concerning aspects of ASML’s earnings update was its net bookings for the September quarter, which totaled just 2.6 billion euros ($2.83 billion). This figure fell significantly short of the 5.6 billion euros forecasted by analysts, raising alarms about the semiconductor industry’s short-term prospects. The sharp decline in bookings indicates that demand for ASML’s products, particularly its highly advanced extreme ultraviolet lithography (EUV) machines, could be facing a temporary stall as customers exercise caution amid economic uncertainty.

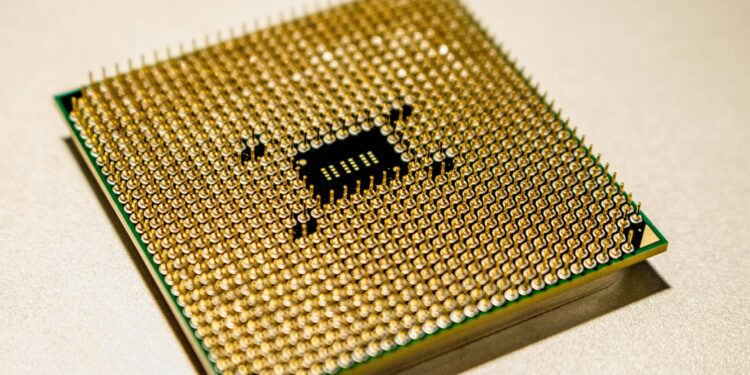

ASML’s EUV machines are critical to the production of cutting-edge semiconductor chips, used by some of the world’s largest chipmakers, including Nvidia and Taiwan Semiconductor Manufacturing Company (TSMC). As global chip production is closely linked to the availability of these advanced machines, any slowdown in ASML’s order flow could have broader implications for the entire semiconductor ecosystem.

China’s Reduced Contribution to Revenue

Adding to the complexity of ASML’s outlook is the evolving role of China in the company’s revenue mix. Chief Financial Officer Roger Dassen noted that ASML expects China to account for around 20% of its total revenue in 2024, a significant decline from the 49% it represented in the company’s second-quarter earnings. This drop in China’s share of ASML’s revenue comes as the country faces increasing geopolitical pressure and trade restrictions, particularly in its semiconductor industry.

Dassen explained that China’s contribution to ASML’s revenue is likely to normalize over the coming quarters, falling in line with historical levels. “We do see China trending towards more historically normal percentages in our business,” he said. While the company does not expect a complete collapse in demand from China, the shift reflects the ongoing global tensions surrounding chip technology and the uncertainty surrounding China’s semiconductor sector amid tightening export controls.

Broader Market Impact

ASML’s disappointing earnings news had a ripple effect across the semiconductor sector. The company’s equipment plays a crucial role in the chip manufacturing supply chain, and any disruption in its sales can signal broader challenges for chipmakers. In response to ASML’s revised forecast, shares of Nvidia, AMD, and Broadcom all fell sharply, illustrating how closely intertwined the fortunes of the chip industry are with the equipment suppliers that enable production.

The overall semiconductor industry has experienced significant volatility over the past year, with periods of high demand driven by the expansion of AI and 5G technologies, followed by slowdowns as inventory levels swelled and economic uncertainty grew. Although the AI sector continues to present strong growth opportunities, other areas, such as personal computing and smartphones, are still facing demand recovery challenges.

Cautious Outlook for 2025

Looking ahead to 2025, ASML’s revised sales forecast suggests that the semiconductor industry is likely to experience a slower recovery than many had hoped. While AI remains a bright spot, the broader market segments that ASML serves may take longer to fully rebound. Investors and industry analysts are now adopting a more cautious outlook, recognizing that the path to growth for ASML and the semiconductor industry may be less linear than previously expected.

In conclusion, ASML’s reduced forecast and declining net bookings indicate that the company is facing headwinds in its core markets. The reduction in China’s contribution to revenue further complicates the outlook, as geopolitical tensions continue to weigh on the global semiconductor landscape. For investors and industry participants, the coming months will be critical in determining whether the chip industry can regain its growth trajectory or if a prolonged period of uncertainty lies ahead.

You might like this article:SoFi Strikes $2 Billion Deal with Fortress Investment to Expand Personal Loan Business