The chipmaking giant rethinks a potential merger amid financial, regulatory, and operational complexities

Qualcomm’s (QCOM) preliminary interest in acquiring Intel Corp. (INTC) which could have been one of the most significant tech deals in history, has reportedly diminished, according to sources familiar with the situation. Although Qualcomm initially considered the acquisition in response to Intel’s recent struggles, the deal’s complexities have made it less attractive.

In September, Qualcomm made an informal approach to Intel, spurred by the latter’s disappointing financial performance and an announced 15% reduction in workforce. Intel’s recent struggles, including a disappointing revenue forecast, a drop in stock value by over 50% this year, and mounting competitive pressures, made the company appear ripe for acquisition. However, financial challenges, regulatory considerations, and operational concerns appear to have dampened Qualcomm’s enthusiasm for a full acquisition.

One of the most daunting issues Qualcomm would face in acquiring Intel is the company’s $50 billion debt, which could strain Qualcomm’s resources significantly. Additionally, regulatory concerns would likely lead to intense scrutiny from antitrust authorities worldwide. Given that China is a critical market for both companies, securing regulatory approvals there would be especially challenging. Qualcomm has reportedly decided to pause any potential acquisition of Intel as it weighs these barriers. Sources indicate that while a full acquisition is unlikely, Qualcomm may still consider purchasing segments of Intel’s business in the future.

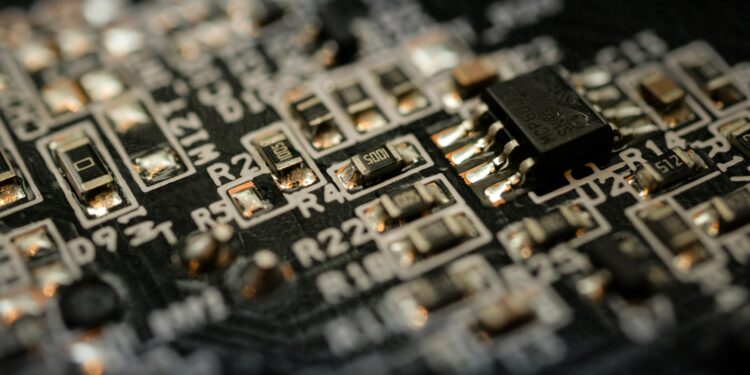

One specific area of concern is Intel’s semiconductor manufacturing division, which has been facing financial difficulties. Qualcomm, which specializes in designing chips rather than manufacturing them, has no experience in managing large-scale semiconductor production. Absorbing Intel’s manufacturing arm would require extensive operational adjustments and potentially steep learning curves for Qualcomm, adding another layer of complexity to any potential deal.

Qualcomm CEO Cristiano Amon recently confirmed in a Bloomberg interview that the company is focused on expanding into new markets, such as personal computers, networking, and automotive chips. These markets could bring an additional $22 billion in annual revenue by fiscal 2029, a goal that Qualcomm aims to achieve without relying on any major acquisition. Amon stated, “Right now, at this time, we have not identified any large acquisition that is necessary for us to execute on this $22 billion.”

Intel, meanwhile, is also in the process of exploring options to streamline its business. CEO Pat Gelsinger, in a recent interview, emphasized the importance of keeping the company unified, stating, “We believe distinct, but better together, is the strategy.” Intel is currently negotiating with potential investors regarding its Altera programmable chip unit. Lattice Semiconductor Corp. has shown interest in purchasing all of Altera, while private equity firms are considering minority stakes. Intel expects to finalize these discussions early next year, a move that may provide additional financial flexibility.

In the face of rising competition from companies like Nvidia, which have led in artificial intelligence chip development, Intel is actively working to reinvent itself. Gelsinger’s leadership and restructuring efforts have received board support, but the company remains under pressure to deliver results and regain its competitive edge.

For now, Qualcomm’s cooled interest signals that it will continue on its own growth path without a massive Intel acquisition. As the tech landscape evolves, however, the possibility remains that Qualcomm may revisit parts of Intel’s business in the future if strategic opportunities align.

You might like this article:Rumble Shares Surge as Dr Disrespect Joins Platform