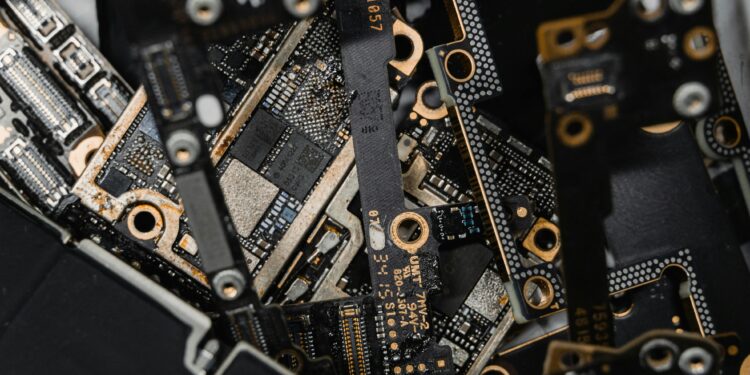

Memory Chipmaker Faces Headwinds in Consumer Markets as AI Revenue Surges

Micron Technology (MU) shares plummeted over 16% on Thursday after the company issued weaker-than-expected revenue guidance for the current quarter, underscoring challenges in consumer-oriented markets despite growing demand for artificial intelligence (AI) chips.

The memory chipmaker, a major supplier to Nvidia (NASDAQ: NVDA), forecasted revenue between $7.7 billion and $8.1 billion for the quarter, falling short of Wall Street’s expectations of $9 billion, according to Bloomberg consensus estimates.

Mixed Signals: AI Strength vs. Consumer Weakness

Micron’s fiscal first-quarter results highlighted a stark dichotomy within the semiconductor industry. On one hand, AI-related chip sales are skyrocketing; on the other, traditional markets like personal computers (PCs) and smartphones remain sluggish.

Micron’s high-bandwidth memory (HBM) chips, integral to Nvidia’s advanced Blackwell GPUs used in data centers, saw substantial demand. In the fiscal first quarter ended November 28, revenue from Micron’s data center segment accounted for over 50% of the company’s total revenue for the first time. HBM sales rose by more than 50% during the quarter.

Conversely, revenue from chips for mobile phones dropped 19%, reflecting prolonged weakness in consumer markets. CEO Sanjay Mehrotra acknowledged the dichotomy, stating, “We are exceptionally well-positioned to leverage AI-driven growth to create substantial value for all stakeholders,” but admitted near-term challenges in consumer-oriented segments.

Analysts Respond

The underwhelming guidance prompted mixed reactions from analysts. Bank of America downgraded Micron to Neutral from Buy, citing concerns that AI-related revenue growth might not be sufficient to counteract the decline in traditional chip markets.

Investment firms including JPMorgan, Raymond James, and TD Cowen lowered their price targets for Micron while maintaining Buy ratings. TD Cowen analyst Krish Sankar noted that the market’s reaction to Micron’s forecast may have been exaggerated given the already anticipated weakness in memory pricing. Sankar revised his price target to $125 from $135.

Long-Term AI Opportunity

Despite current challenges, Micron remains optimistic about the burgeoning AI market. The company raised its 2025 market forecast for HBM to $30 billion, up from a previous estimate of $25 billion. Micron expects its own HBM revenue to grow from several hundred million dollars in fiscal 2024 to multiple billions by 2025.

Micron’s fiscal first-quarter earnings per share of $1.79 slightly exceeded estimates of $1.76, with revenue of $8.7 billion aligning with forecasts. However, investors were unimpressed, sending shares to close at $87 on Thursday.

Outlook

While Micron’s AI-focused segments offer significant long-term potential, near-term pressures from weak consumer demand and memory pricing will remain key hurdles. The company’s ability to navigate these challenges while capitalizing on the AI boom will likely dictate its future performance.

You might like this article:Nike Reports Q2 2025 Results: Revenue Decline Sparks Strategic Repositioning