As Nvidia’s Stock Soars, Concerns Arise Over Huang’s Selloff Strategy and the Future of Leadership

Five years ago, Jensen Huang, CEO of Nvidia (NVDA), was worth a respectable $3.73 billion. Fast forward to today, and his net worth has skyrocketed to over $92 billion, peaking at $119 billion earlier this summer. This dramatic increase reflects Nvidia’s recent stock surge, which has catapulted the company into the spotlight and brought its leadership under intense scrutiny.

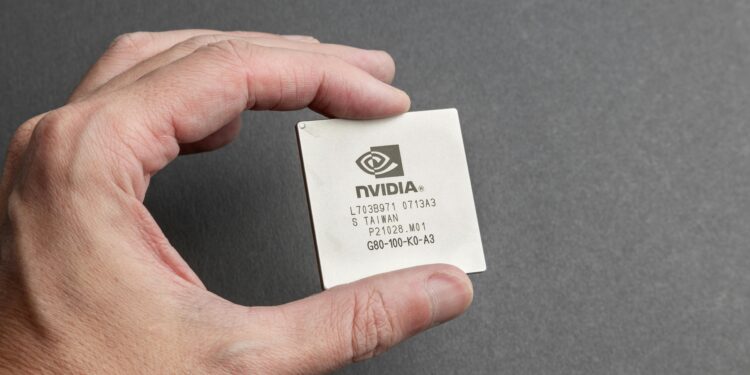

While Huang has been at the helm of Nvidia for over three decades, the past 12 months have been transformative for the chipmaker, particularly as its stock price has soared. Investors have been largely thrilled with their returns, likening Huang to a tech industry superstar. However, his recent decision to sell a substantial portion of his Nvidia shares has raised eyebrows among investors and industry experts alike.

The Rule 10b5-1 and Its Implications

Huang’s stock sales are conducted under a Rule 10b5-1 trading plan, which allows executives to sell predetermined amounts of stock at specified times, insulated from accusations of insider trading. This rule requires that a formula, rather than an individual, determines the number, price, and date of the trades. Additionally, the sales must be conducted by a third party, ensuring that the executive cannot influence the process.

Despite these safeguards, the timing of Huang’s stock sales—following a period of high share performance and subsequent dip—has sparked concern. Nell Minow, vice chair of corporate governance specialists ValueEdge Advisors and an Nvidia shareholder, expressed her unease. “What I want from an executive is to be very bullish on the stock,” Minow said. “I want them to think, ‘Boy, this is really going to be worth a lot more soon,’ not ‘Oof, I better sell some because I’m experiencing the vertigo of having all my eggs in one basket.'”

Huang’s use of Rule 10b5-1 is not new; he employed the strategy last year as well. However, this year’s sales have been more aggressive. For instance, in July alone, Huang sold $323 million worth of Nvidia stock, compared to $117 million in September last year. This trend has not gone unnoticed by investors, with some questioning whether they should follow suit and sell their shares as well.

Balancing Stock Sales with Market Confidence

James Reda, a managing director at Gallagher’s HR and compensation practice, argues that Huang’s approach to selling his stock—drip-feeding the market with small sales rather than offloading large sums at once—is a prudent strategy. “If you just dump that in the market, the stock’s going to go down,” Reda explained. “So you have to be very sensitive about it… If you have a large position like some of these founders and CEOs have, it could be a better strategy.”

Reda also noted that Huang’s near-daily sales are in line with the 10b5-1 plan, which is public knowledge. This transparency helps prevent market shocks and ensures that investors are not blindsided by sudden large stock dumps. However, Minow remains unconvinced, arguing that Huang has been given too much stock and that his holdings should be locked in “golden handcuffs,” preventing him from selling until years after he leaves the company.

Nvidia’s Compensation Practices Under Scrutiny

Nvidia’s 2024 proxy filing reveals that Huang’s total compensation package for the fiscal year was approximately $34.17 million, including a salary of $996,514, stock awards worth $26 million, and additional cash compensation of $4 million. Before his recent stock sales, Huang held over 93 million shares in Nvidia, representing 3.79% of the company.

Minow believes that Nvidia’s practice of awarding substantial stock to its CEO is problematic. She suggests that the company should focus on creating specific goals for its leadership, such as market share expansion, innovation, and operational improvements. These goals would provide clearer metrics for investors to assess the company’s performance and would align the interests of the CEO with those of the shareholders.

The Need for Succession Planning and Governance

Beyond compensation concerns, Minow also calls for Nvidia to improve its corporate governance, particularly in terms of succession planning. Of the 12 individuals on Nvidia’s board, only one has experience in corporate governance, raising questions about the board’s ability to navigate future leadership transitions.

Minow emphasizes the importance of transparency in succession planning, noting that Nvidia should be preparing for the possibility that Huang may eventually step down. Aalap Shah, managing director at compensation and leadership consultancy Pearl Meyer, echoes this sentiment, arguing that succession planning should be a top priority for any forward-looking company.

The Future of Nvidia Without Huang

As Nvidia continues to thrive under Huang’s leadership, the question of what the company might look like without him looms large. While Huang remains the driving force behind Nvidia’s success, ensuring a smooth transition to future leadership is crucial for the company’s long-term stability. Investors and analysts alike will be watching closely to see how Nvidia addresses these challenges and prepares for a future beyond Huang’s tenure.

In the meantime, the market will continue to monitor Huang’s stock sales and the broader implications they may have for Nvidia’s stock price and investor confidence. As one of the richest and most influential figures in the tech industry, Huang’s decisions will undoubtedly have a lasting impact on Nvidia and its shareholders.

You might like this article:Peloton Shifts Focus to Profitability Amid Modest Sales Growth After Nine Quarters