Former Google CEO Eric Schmidt Highlights Massive Investments in AI Data Centers

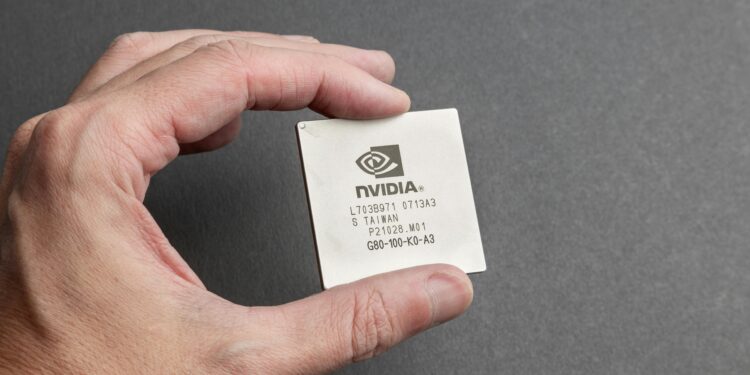

In a rapidly evolving tech landscape, artificial intelligence (AI) has emerged as the focal point for innovation and investment. Former Google (GOOGL) CEO Eric Schmidt recently underscored the magnitude of this trend, revealing that major technology companies are gearing up for unprecedented investments in AI infrastructure, particularly in data centers powered by Nvidia’s (NVDA) cutting-edge chips. His insights shed light on the staggering scale of these investments and the critical role Nvidia plays in the burgeoning AI industry.

Speaking at Stanford University, Schmidt disclosed that the leading tech giants are preparing to pour billions into AI infrastructure. “I’m talking to the big companies, and the big companies are telling me they need $20 billion, $50 billion, $100 billion,” Schmidt said, emphasizing the colossal sums involved. His comments, delivered during a session on AI, were captured in a video that was later removed by Stanford at Schmidt’s request.

These investments are primarily directed toward Nvidia-based AI data centers, with Schmidt suggesting that the total cost could reach as much as $300 billion. Nvidia, known for its dominance in AI chip manufacturing, has already seen its revenue surge by over 200% for three consecutive quarters. This remarkable growth is driven by the soaring demand from cloud companies and AI model developers who rely on Nvidia’s powerful GPUs to train and deploy advanced AI systems.

Schmidt’s remarks provide a glimpse into the driving forces behind Nvidia’s meteoric rise and the central role the company plays in the ongoing AI boom. “If $300 billion is all going to Nvidia, you know what to do in the stock market,” Schmidt quipped, though he was quick to clarify that this was not intended as investment advice. Despite his strong endorsement of Nvidia, Schmidt did not disclose whether he owns any shares in the company.

As the former CEO of Google from 2001 to 2011, Schmidt’s perspective carries significant weight in the tech industry. He served on Google’s board until 2019 and remains closely connected to the world of AI, both as an investor and a strategic advisor. Schmidt’s connections include a close friendship with OpenAI CEO Sam Altman, further solidifying his position as an influential figure in the AI community.

While Nvidia is the clear leader in AI hardware, Schmidt noted that the company might not be the only winner in this rapidly expanding field. However, he acknowledged the challenge faced by smaller companies trying to compete with the tech giants. “At the moment, the gap between the frontier models — there are only three — and everyone else appears to be getting larger,” Schmidt observed. “Six months ago, I was convinced that the gap was getting smaller, so I invested lots of money in the little companies. Now I’m not so sure.”

The AI arms race has led to a concentration of power among a select few companies with the resources to invest heavily in Nvidia’s chips and the accompanying infrastructure. Schmidt highlighted this trend by pointing to Meta (formerly Facebook) and its CEO Mark Zuckerberg. Meta has reportedly acquired around 600,000 of Nvidia’s GPUs to support its next-generation AI models. Zuckerberg has indicated that future models in Meta’s Llama family will require access to even more computing power, further driving demand for Nvidia’s technology.

In addition to Meta, Microsoft has also been making substantial investments in AI infrastructure. Schmidt referenced the collaboration between Microsoft and OpenAI, where the tech giant is working on a $100 billion data center project dubbed “Stargate.” Schmidt initially questioned the wisdom of Microsoft’s decision to outsource its AI leadership to OpenAI, but he now acknowledges that the move may prove to be transformative for the company.

One of the key factors contributing to Nvidia’s dominance in the AI space is its CUDA programming language, which has become the foundation for many of the most important open-source tools used by AI developers. Schmidt noted that while AMD, a competitor to Nvidia, has developed software to translate CUDA code for its own chips, it “doesn’t work yet,” further solidifying Nvidia’s competitive edge.

As the AI revolution continues to accelerate, Schmidt’s insights offer a valuable perspective on the immense investments being made in AI infrastructure and the critical role Nvidia plays in this evolving landscape. With billions of dollars at stake, the race to build the most advanced AI data centers is only just beginning, and the winners of this race could shape the future of technology for years to come.

You might like this article:Cisco Systems Soars with Bullish Forecast Amid Workforce Cuts and Strategic Shift